Finmo - Overview and Guide

Introduction

Finmo is a financial technology (fintech) company providing a comprehensive suite of products and services to streamline and enhance financial operations for businesses of all sizes. Our cloud-based platform offers a centralized hub for managing money movement, cash management, FX management, integration, and compliance.

Built on real-time payment rails across borders, Finmo enables businesses to make instant money transfers, accurately forecast cash flows, optimize liquidity, mitigate financial risks, and seamlessly adhere to financial regulations.

Products and Services

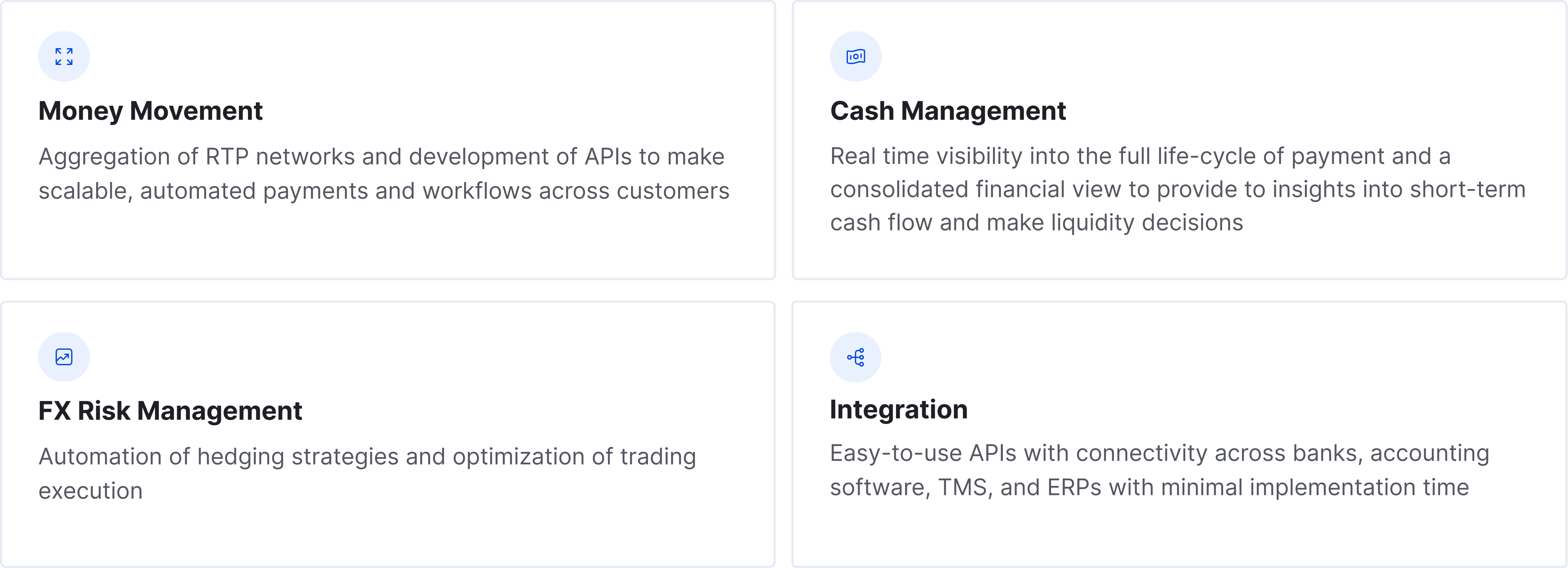

Finmo's offerings encompass a wide range of functionalities that cater to the diverse financial needs of businesses:

Technical Architecture

Finmo's cloud-based infrastructure is built on a secure and scalable architecture, utilizing cutting-edge technologies to deliver reliable and resilient performance.

Real-time Payments Rails: Employs real-time payments infrastructure to facilitate instant money transfers and enable continuous financial visibility.

Microservices Architecture: Leverages a microservices architecture to ensure the platform's modularity, flexibility, and scalability.

API-First Approach: Adopts an API-first approach to enable seamless integration with third-party applications and systems.

Data Security: Implements robust data security measures, including encryption, access controls, and intrusion detection systems.

Benefits of Using Finmo

Businesses that adopt Finmo's solutions can reap a multitude of benefits

Real-Time Transactions: Enjoy Real-Time transfer of funds, thus growing your business to the next level.

Cross-Border: Seamlessly transact and convert across countries and currencies, besides local fund movement.

Reduce Costs: Automates manual processes, eliminates the need for expensive financial software and streamlines operations, leading to cost savings.

Improved Efficiency: Enhances financial processes with automation, real-time data insights and centralized management, boosting overall efficiency.

Increased Transparency: Provides a single source of truth for financial data, enhancing transparency and facilitating informed decision-making.

Reduced Risk: Identifies, monitors, and mitigates financial risks associated with payments, cash flows, and foreign exchange transactions.

Enhanced Compliance: Ensures adherence to financial regulations, reducing the risk of penalties and legal issues.

Scalability: Supports businesses of all sizes, from startups to enterprises, with its scalable architecture and flexible solutions.

Please visit our FAQs page for getting assistance with common queries and issues.

Updated 2 months ago