Money Movement

Overview

This module covers key terminologies used in the Finmo system for collections and payouts via various payment rails, both local and cross-border. This helps businesses create a desired transaction flow.

Key Terms

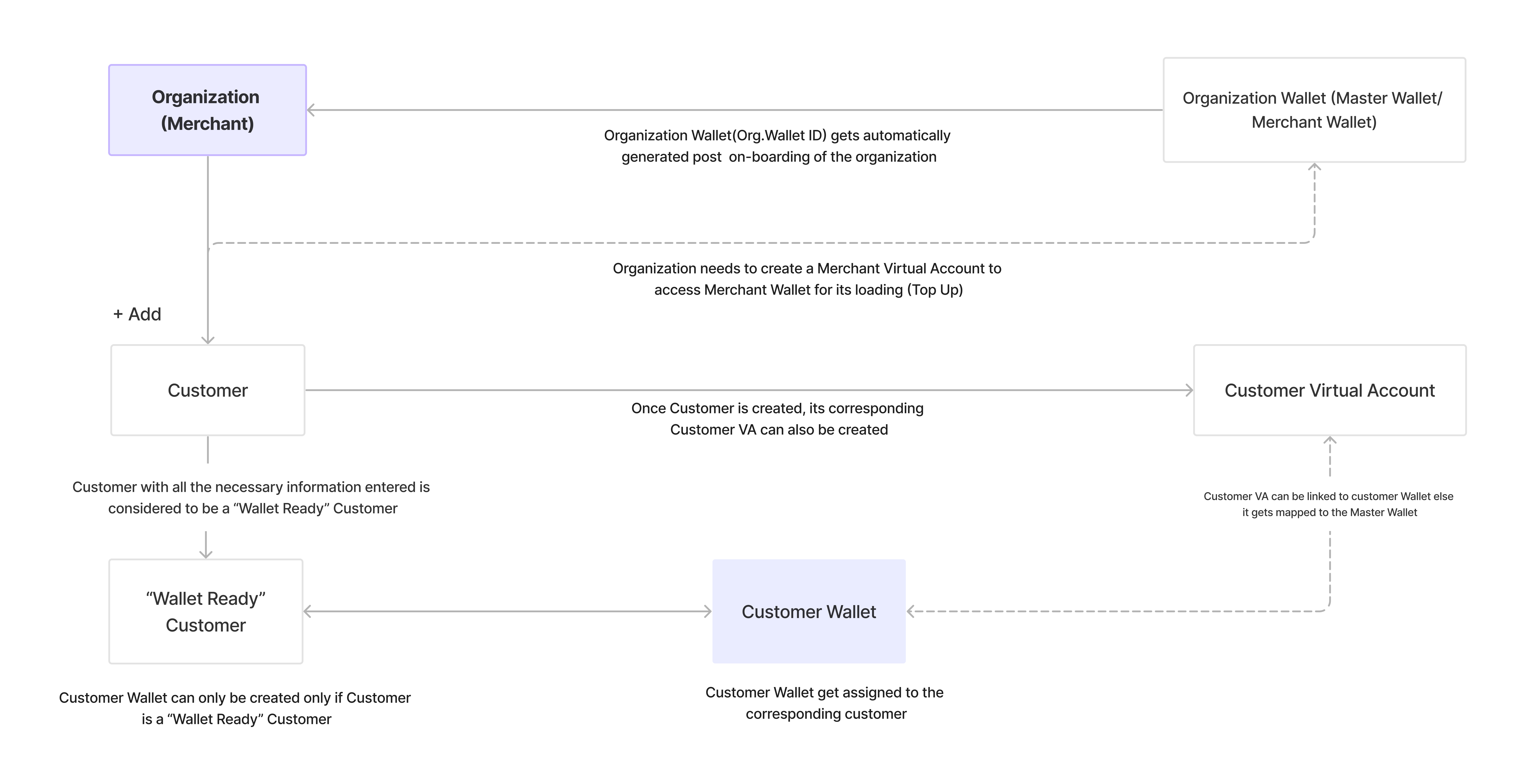

Organisation

When you sign up on the Finmo platform, an account is set up which is internally identified via organization ID . You can find the organization ID here.

Customer

Merchants can onboard their customers on the Finmo platform using customer entity in Finmo. A customer is a subset of a merchant (organization), as merchants can create customers according to their specific use case requirements. It can be either Individual or Company. Each customer will have a unique customer ID. While one organization can have many customers, a customer can only be associated with one organization.

Wallet

Wallets are digital accounts that store, manage, and facilitate transactions in different currencies. These wallets allow users to hold and transact in multiple currencies, making it easier to manage cross-border payments and international transactions. Finmo categorizes them further under i) Master wallets or organization wallets and ii) customer wallets. When you sign up, Finmo creates 3 wallets for you: Payin, Payout, and Fees, which we call 'Organisation Wallets'. You can view the wallet details in both Sandbox and Production.

Payin Wallet

This is where all the funds collected from your customers are deposited. Any applicable fees (inclusive of taxes) against this transaction will be applied to the Fees wallet. You will also see 2 ledger entries: one credit entry in your Payin wallet for the amount of funds we received and the second will be a debit entry for the Finmo Fees under your Fees wallet.

Payout Wallet

Finmo Payout wallet works based on a 'good funds' model i.e. you are required to load funds into your Payout Wallet before you can start making Payouts. For Payout wallets, we have a concept of RESERVE and RELEASE functionality where Finmo blocks the funds in the wallet when a Payout request is made but not completed yet. Once the Payout is completed we will release the funds and debit the Payout wallet and the fees wallet.

Fees Wallet

As the name suggests, any Finmo fees (including any applicable local taxes) will be charged to this wallet. Finmo works on a real-time fee settlement model. All transactions and currency conversions will be charged as per the pricing schedule in your MSA and debited from the balance available in your fee wallet. Ensure there are sufficient funds available in the fee wallet.

NoteLoading funds to Payin wallet may be needed for Refunds. Consider a situation where you need to initiate a refund on a previous transaction with the assumption that the collected funds have already been settled to you and the Payin wallet does not hold enough balance, you will need to either load the funds or wait to receive enough funds from future orders to make the refund happen.

Organisation can create any number of Customer wallets as per its use case, provided they have created a ‘Wallet Ready’ Customer.

Virtual Account

A virtual account (VA) probably is called by different names in different countries. But in essence, a Virtual account is an account or an account proxy such as PayID issued by a bank operating under Finmo. The funds are still held by Finmo's custodian bank but they are virtually segregated so we know the funds belong to you or your consumers.

Balance

Finmo has the concept of Current Balance and Available Balance just like we see in Credit Cards. Available Balance is similar to Open-to-Buy and is checked for all Refunds, and Payouts made by you from your respective wallets. Available Balance and Current Balance will be different in situations where there are any blocks/reserves made by Finmo for an ongoing transaction that is in a PENDING state. In our experience, it's mostly refunds and payouts that are structured in this way.

Wallet Fund Transfer

Merchants can transfer funds from one wallet to another, via the API or from the Dashboard itself. This transfer happens among the wallets of the same organization, thus enabling them to move funds internally as per their usage and needs.

Settlement and Invoicing

During your business account activation, you can review the Pricing & Settlement terms applicable to your business account. Finmo by default works on NET settlement. Funds will be settled after deducting any pending fees or invoices.

Finmo generates an invoice summary at the end of every month for any applicable fees due by you. An email notification will be sent as well once the invoice is generated. You would need to log in to the dashboard to view them.

Use Cases

Finmo’s Payment stack is used to power several use cases:

- The real-time transactions help the merchants to grow their businesses exponentially and efficiently by faster collection and disbursement of funds.

- It enables merchants to collect payments from customers via various means.

- It allows merchants to transfer funds both locally and globally, that too in real-time.

Updated 3 months ago